What causes the Business Cycle?

The reasons for the business cycle in capitalism are numerous, to say the least. Whether it’s ideology, acquired academic rhetoric or simple open-loop mental models is anyone’s guess. Theories include interest rates, changes in house prices, consumer and business confidence, the multiplier effect, the accelerator effect, and so on.

All these examples correlate in strange and fascinating ways, but the keyword is correlated; this is opposed to causation. It involves closing the loops in a mental model, looking at the hard data, and creating relationships between variables. This is easier said than done, of course, and by no means do I trivialize the complex nature of the economy. There seems to be a human tendency to break down complex issues into smaller parts and then try to resurrect their original composition.

However, this run’s straight into the “Fallacy of Composition”. If a human body could be broken into its smallest parts, let’s say atoms, are the atoms alive? Not according to our current definition of life, so if one were to reassemble those atoms into a human body, would it be alive? The Paradox of thrift is another example; in a quick, simplistic explanation, an individual saving is to the benefit of the said individual and, therefore, must benefit the entire population if everyone were to save. This is deleterious to the whole of the economy, but an individual that fails to see this paradox would fall into the fallacy of composition.

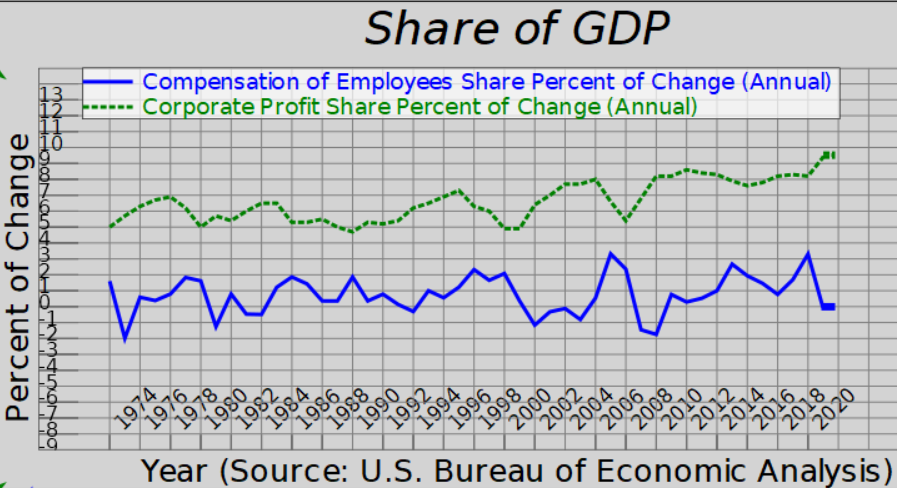

Why I took the detour in explaining this was necessary to make my first point about why and how the business cycle happens. One can derive macroeconomic definitions from macro itself. Below, in the figure, are two such macro definitions.

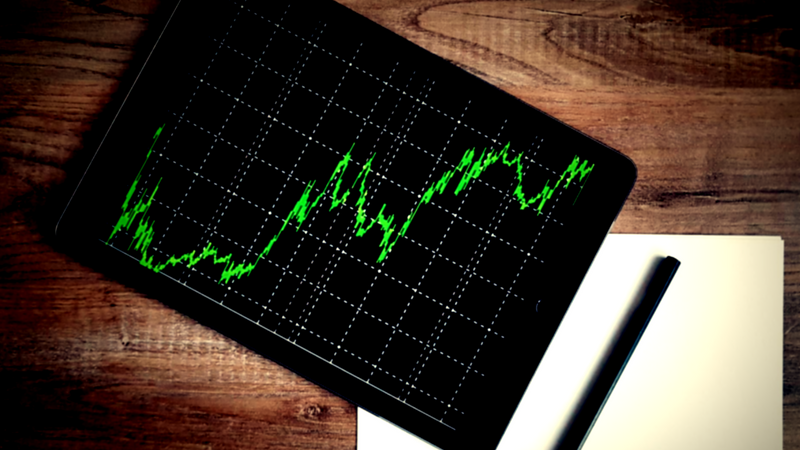

When I look at this graph, I don’t just see profits and wages; I see the root of the business cycle. I see wages crowding out investment, and then I see firms laying off workers to cut wage costs so the investment can accumulate into capital. I see endogenous behavior. I see output growing because of a large capital stock requiring more employees. I see wages rising due to a competitive market for labor and once again crowding out investment. As you see, I closed the loop.

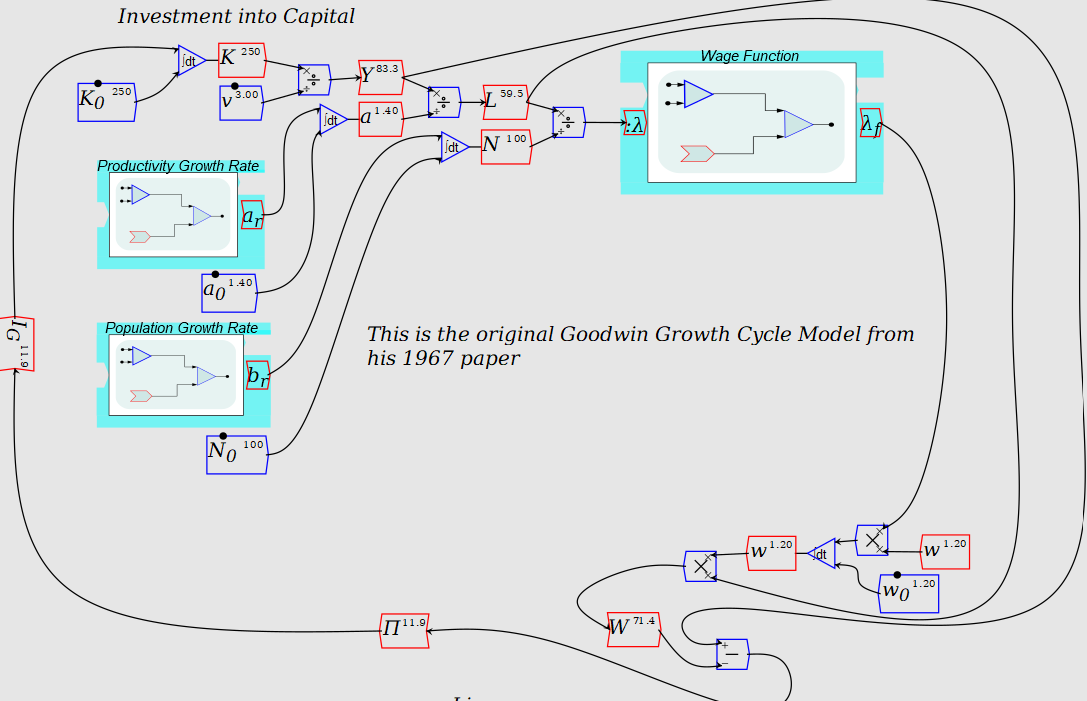

As a practitioner of System Dynamics, I tend to look under the hood of complex systems for feedback loops. The mode of behavior in the figure above exhibits an oscillation. It’s an indication of variables attracting and repelling one another. To take the hunch further, an experiment needs to be performed. One such experiment is the Goodwin Growth Cycle Model by Richard Goodwin in 1961. The model is based on the area of change over time using calculus. Without getting into mathematical equations, I will describe the model in the sense of its flow. Goodwin starts with a stock of capital divided by a capital-output ratio to define the output. He then defines productivity as a constant and divides output to get labor. The population in this model is held at a constant. Labour is divided by population to get an employment ratio; this is fed into a function that states if the employment ratio is above a certain level, wages rise. This creates a multiplier variable used to multiply a stock variable called wages. Wages are then multiplied by the labor variable to get total wages, and output minus total wages equals profits. In this simple model, all profits are invested into capital, completing the loop.

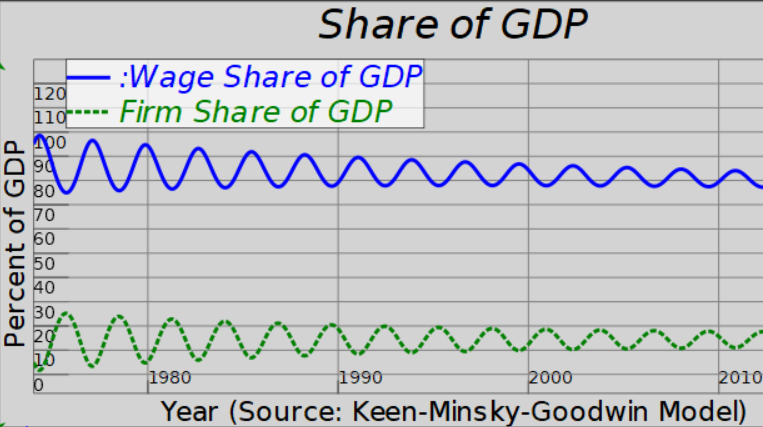

One can create a profit and wage share by dividing both separately with output. I did this with the Keen-Minsky-Goodwin cycle model. This model is an expanded version of the original Goodwin model, where Steve Keen added a third system state for debt (the other two system states are capital and wages). This does not change the qualitative result observed in the figure below in a significant way, though there is an effect I will mention later.

I see mathematical solid evidence from the oscillation mode of behavior in the model that corresponds to the data we see in the real world. It’s not that I deny that there are exogenous shocks that happen; I reject the Neo-classical view that everything remains in perfect equilibrium and shocks are the driving force for our economic cycles. At best, these “shocks” augment the endogenous nature of the economy. The confused state and convoluted explanations for the business cycle generally come from the fake math generated by the Neo-classical school that dominates economics. One in which models are based on discrete time, and money does not matter. This is why I study the greats like Bill Phillips, Richard Goodwin, Hyman Minsky, Wynne Godley, and Steve Keen. It’s okay to think outside of the box; paradigm shifts are as natural as biological evolution.

As Marx pointed out over 150 years ago, capitalism is a constant battle between capitalists and workers. However, in today’s age, it is masked with economic jargon, politics, and half-thought-out opinions. I must point out that other endogenous behaviors influence the cycle between profits and wages, the level of private debt is one of them and has been an impairment to wage growth since the 70s.

As with anything in economics, all things are subjective at face value. Each of us sees the world from our own perspective. When a person looks at a hydro dam, they see a body of water and a wall blocking it. They assume the inner workings and move on. They could never design a dam just by looking at it. Engineers have used dynamics for centuries to understand complex systems involving the movement of water through the application of calculus. Over the past 40-plus years, they have turned to unique software packages like Simulink. The human sciences have adopted the same tools as well with software like Vensim and Stella. Discoveries have been made from simple models that capture behaviors via feedback loops that have revolutionized our planet. I demonstrated the cause of economic cycles through the theories of the greats mentioned above in 1000 words that have perplexed mainstream economists throughout the 20thcentury. A relatively new entry to the world of system dynamics software is Minsky. It is specifically designed to be used to model economic situations in continuous time. So now you can test an issue for yourself and tell all your friends you know what causes the business cycle