How to Mangle Money

In my last column, I explained how both governments and banks create money. The basics are incredibly simple—so simple, in fact, that the great non-mainstream economist John Kenneth Galbraith once commented that:

The process by which banks create money is so simple that the mind is repelled. Where something so important is involved, a deeper mystery seems only decent.

— (Galbraith 1975, p. 22)

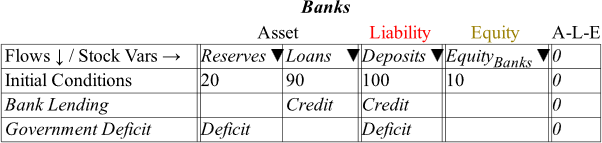

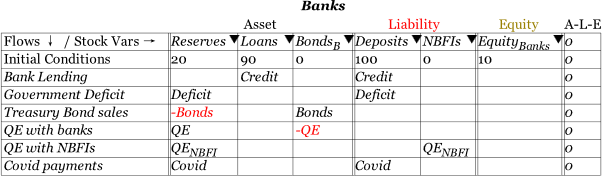

Figure 1 shows the almost offensively simple actions that create money. Banks put dollars per year into the Deposit accounts of their customers, matched dollar for dollar by recording dollars per year additional debt owed by their customers. Governments put dollars per year into the bank accounts of their citizens, and the same funds, dollar for dollar, into the Reserve accounts of the banks.

There are more steps involved, as I explained in my last column, but there is no "deeper mystery": banks and governments can both create money simply because they can both type numbers into bank deposit accounts. That's it.

However, if you read an economics textbook, you'll find much deeper mysteries: Fractional Reserve Banking; Lending from Reserves; the Money Multiplier; Loanable Funds… These mystery stories have one thing in common: they're all wrong! They mangle money, rather than explain it.

This wouldn't matter if these were just silly stories believed by people of no consequence. But unfortunately, they're silly stories believed by economists who often have substantial power over economic policy. These silly stories can then have incredibly detrimental effects on the real economy.

For instance, guess what Charles Plosser, President of the Federal Reserve Bank of Philadelphia, was most worried about at the depths of the Great Recession in December 2009, when unemployment in the USA reached 10%?

Inflation.

His argument was that the cost banks faced in "holding on to vast excess reserves…

may lead to a rapid increase in the money multiplier and a conversion of excess reserves into loans or borrowed money… Thus, I see a greater upside risk in the medium term—the two to five-year term—to inflation than the Greenbook does. (Minutes of Federal Open Market Committee on

—December 15–16, 2009, p. 55)

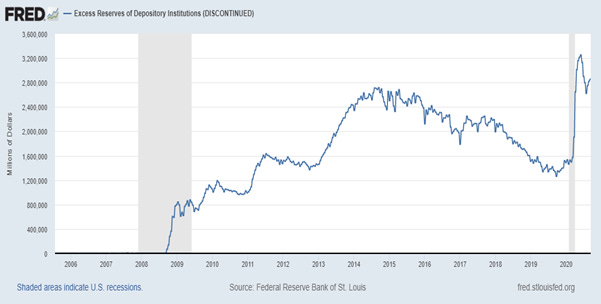

Excess Reserves are reserves in excess of the requirement, known as the Required Reserve Ratio, that banks must hold Reserves equivalent to 10% of their deposits. Excess Reserves were indeed high—they had risen from essentially zero to over a trillion dollars in just 15 months (see Figure 2), thanks to the deliberate Federal Reserve policy of "Quantitative Easing". Plosser was afraid that these excess reserves would spark a huge increase in the money supply, and thus trigger inflation.

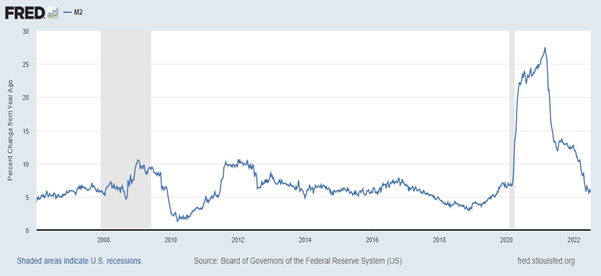

But instead, the rate of money creation remained subdued—comparable to the rate that applied when there were no excess reserves. However, the Covid crisis also caused a huge increase in excess reserves, and this did lead to a rapid increase in the money supply--see Figure 3.

So, why did one increase in excess reserves have very little impact on the money supply, while another had a huge impact? It's easy to answer this question, using the simple monetary system shown in Figure 1. We just need to add another asset to Figure 1—Bonds owned by the banks—and another Liability—deposit accounts of Non-Bank Financial Institutions at the banks, since Quantitative Easing bought bonds off both banks and Non-Bank Financial Institutions ("NBFIs"—pension funds, hedge funds, insurance companies etc). Figure 4 adds four additional operations to Figure 1: the standard practice of the Treasury selling bonds to the Banks that are the same value as the deficit; QE for both banks and NBFIs; and support payments during Covid.

Laid out this way, it's easy to see why the Quantitative Easing did very little to increase the money supply, while Covid payments radically increased it.

Quantitative Easing with banks creates no money: it simply reduces the value of the bonds held by the banking sector, and increases the value of their reserves by just as much. In this way, it reverses the standard process of the Treasury issuing bonds equal to the deficit. The only way this could create money would be if banks lent out these excess reserves—which Neoclassical economists like Plosser and Bernanke thought would happen. As Bernanke put it:

Large increases in bank reserves brought about through central bank loans or purchases of securities are a characteristic feature of the unconventional policy approach known as quantitative easing. The idea behind quantitative easing is to provide banks with substantial excess liquidity in the hope that they will choose to use some part of that liquidity to make loans or buy other assets.

— (Bernanke 2009, p. 5. Emphasis added.)

This was a false hope, born of a bad model of how money is created, as I'll explain shortly.

Quantitative Easing with NBFIs does create money—but NBFIs aren't free to spend this money on goods and services from the physical economy. Instead, their first use of the funds must be to buy what they are permitted to buy with they receive money: shares, properties, etc—financial assets. This increased money dramatically affected asset prices, but there was only a small spillover effect into the real economy: salaries of NBFI staff, NBFI profits, purchases of goods from the physical economy (computers, data services, etc.). So this aspect of QE directly increased the amount of money in the financial system, and indirectly increased the amount of money in the physical economy by a much smaller amount.

Covid payments, on the other hand, created money that went directly to households and corporations in the physical economy—as opposed to the FIRE (Finance, Insurance and Real Estate) sector. They were free to spend this money as they wished—and we got a sudden boom as a result, with the rate of growth of the money supply jumping abruptly from 7% p.a. in February 2020 to 23% p.a. in June 2020, and reaching a peak rate of growth of 27% p.a. in March 2021.

Thank you for reading Building a New Economics. This post is public so feel free to share it.

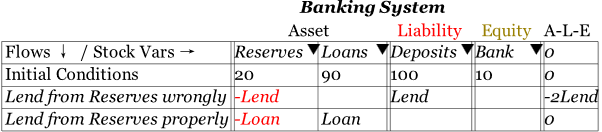

QE didn't cause a boost to lending and the money supply, as Plosser and Bernanke believed it would, because the money creation models they believe in are simply wrong. The two models are "Fractional Reserve Banking" and "The Money Multiplier" ( there's another false theory, "Loanable Funds", but that's irrelevant here). In them both, banks can easily lend from Reserves. But economists have never checked the accounting involved, and it's simply wrong.

There are two ways of showing banks lending from Reserves, neither of which work:

- By showing Reserves going down and Deposits going up, which breaks the "fundamental law of accounting" that : see the first row of Figure 5; and

- By showing Reserves going down and Loans going up: see the second row of Figure 5. This is correct in accounting terms, but there's a problem: where is the money that the borrower is supposed to receive?

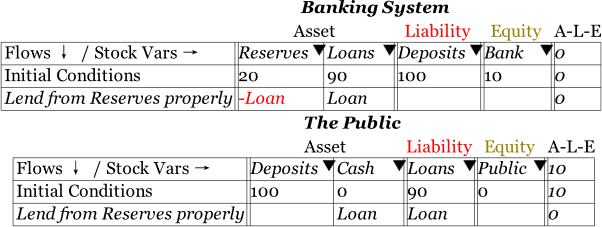

The only way that this second row can show the borrower receiving money from the loan is if the loan is in cash. So for "Fractional Reserve Banking" and "the Money Multiplier" to work, all loans must be in cash. Figure 6 shows this: the public's holdings of cash increase by the same amount that their debt to the banks has risen.

Cash loans may have been commonplace in the 19th century, but this is the 21st. Banks lend, very simply, as shown in Figure 1, by increasing their Loans and Deposits by the same amount. Reserves are irrelevant—or rather, an afterthought.

Think of the consequences this mistaken model has. The "substantial excess liquidity" that Bernanke's Fed pumped into the banks was impotent—and yet that, and not fiscal policy, bore the brunt of the government effort to pull the economy out of The Great Recession. On the other hand, because the Covid payments had to go directly to households and firms, fiscal policy was used—and that had the bang needed to do the job of not only preventing an economic collapse, but of making the Covid recession the shortest in American history.

If policymakers had simply understood the accounting of money back in 2008, rather than believing in mainstream economic theory, then fiscal policy could have been used strongly to stimulate the economy out of its slump. But because they believed these false, mainstream economic models, America struggled through the slowest recovery in its economic history.

There are serious consequences to being wrong about how money is created.

(BTW, the "Required Reserve Ratio was abolished in March 2020).

REFERENCES

Bernanke, Ben. 2009. "The Federal Reserve's Balance Sheet: An Update." In Federal Reserve Board Conference on Key Developments in Monetary Policy. Washington, DC: Board of Governors of the Federal Reserve System.

Galbraith, John Kenneth. 1975. Money: whence it came, where it went (Houghton Mifflin: Boston).